Tackling international shipments can feel like a nightmare, especially so for first time importers. It's a confusing, long process.

This ultimate guide is your one stop shop for all things importing from China, from start to finish - it covers shipping methods, import documents, calculating tax and special customs requirements for specific countries.

Chapter 1: Choose Your Shipping Method

For international shipments, there are two major transportation methods you can choose from - air freight and ocean freight.

Air Freight

1. Air Courier

What is it?

It’s the simplest of all, and the easiest to understand. You've heard of UPS, DHL, and FedEx, yeah? They’re your air couriers!

One really good thing about air couriers is that they offer door to door service, which means that they can pick up the goods at your factory and deliver it to your doorstep directly.

When is it ideal to choose air couriers?

It’ll work out cheaper to choose air couriers for shipments weighing less than 150 kg.

2. Traditional Air Freight

What is it?

This is a more complex process which involves arranging for transportation of goods through a party called a freight forwarder.

Usually, traditional air freight services are terminal to terminal - meaning either you arrange transportation form the factory to the airport terminal OR you can ask the freight forwarder to take care of pick up for an extra fee.

When is it ideal to choose traditional air freight?

It’s best to choose traditional air freight for shipments weighing between 150 kg and 500 kg.

Here’s an overview comparison of Air Courier and Traditional Air Freight:

How are air freight charges calculated?

Air freight cost = rate per kilogram x chargeable weight

Chargeable weight = volumetric weight VS gross weight, whichever is greater.

You can visit our Air Freight FAQ where we answer how the air freight costs are calculated in detail along with the answers to many burning questions on air freight that we often hear.

Ocean Freight

Goods are either shipped in containers or in bulk. But here, we’re more focused on containerised freight - LCL and FCL.

1. LCL

What is it?

LCL (Less than Container Load) is a consolidated shipment - meaning that your shipment will be combined with other people’s shipments into a container. LCL is ideal for smaller shipments.

When is it ideal to choose LCL?

If your shipment is LESS than 13 CBM, choose LCL shipments.

2. FCL

What is it?

FCL (Full Container Load) is more of an individual shipment - it’s when a single shipper’s cargo takes up the space of an entire or near full capacity of a container (of any size).

When is it ideal to choose FCL?

If your shipment is GREATER than 15 CBM, choose LCL shipments.

For shipments between 13 - 15 CBM, you should get quotations for LCL and FCL, compare and choose.

What are the benefits of FCL vs. LCL ?

Is there a “Sea Courier” option?

Technically, no. But, there is an express ocean freight service called speed boat, but it’s still port to port (NOT door to door like an air courier).

So, Which Type of Freight Should You Choose?

Ultimately, the cost comes down to volume and the weight of your shipment.

• For smaller volumes, or high value goods - choose Air freight.

• For larger volumes, or low-value goods - choose Ocean freight.

But, there are also other factors such as speed, reliability, and even environment friendliness - read our How to Choose Between Air Freight and Ocean Freight? guide for more information.

Now, there’s one last thing to cover that affects your choice of transportation mode and your shipping costs, and it is… *drum roll please*...

Incoterms!

That's right! It’s incoterms - short for International Commercial Trade terms. And don’t worry if you’ve never heard of them, we'll break them down and explain to you in plain English :)

What are incoterms?

They are trade terms that a buyer and seller will have to come to an agreement with, and which ultimately decides the sales prices AND their responsibilities - like arranging for main transportation, insurance, customs clearance, loading and unloading of the goods!

🚨The following terms - FAS, FOB, CFR, CIF are ONLY applicable for Ocean freight.

What are the popular incoterms for the buyer?

Buyers commonly choose or prefer the following:

Rank #1 - FOB

FOB (Free on Board) gives you (the buyer) control of your goods and relatively low shipping costs since you get to negotiate and find a freight forwarder of your choice.

The seller takes over the harder part - getting the goods onto the ship and arranging export clearance.

When is it best to use FOB terms?

Works best for shipping bulk or break bulk goods such as oil, grains, coal, or bagged cement. For containerised cargo, it’s better to use FCA terms.

Rank #2 - EXW

Gives you complete control over the goods, there is only one party responsible for arranging for your cargo’s departure.

With other terms, it's usually a collaboration between the supplier and forwarder - which may increase the risk of miscommunication.

When is it best to use EXW terms?

Works best for local or within borders transportation of goods. Or for buyers who want complete control over their goods and its transportation.

Rank #3 - DPU

DPU, previously known as the DAT (Delivered at Terminal), is a popular choice if the buyer does not want to or does not know how to arrange for transportation and insurance.

Under DPU the buyer is only responsible for 2 things: import clearance & duties, and unloading costs at the final destination.

When is it best to use DPU terms?

Works best for LCL or consolidated shipments with multiple receivers - the seller can unload the goods, separate the shipments and make them available to them.

🚨 Keep in mind that these are the popular terms - it may not be the best for your good type and value. So, do consider other options.

You can explore the terms individually, and we even tell you when to choose the specific term:

4. CIP (Carriage & Insurance Paid to)

5. DAT (Delivered at Place Unloaded)

7. DDP (Delivery and Duties Paid)

11. CIF (Cost Insurance Freight)

Or we also include DDU (Delivery and Duties Unpaid) - it’s the older version of DAT but still popular even in 2020.

Chapter 2: Import Documents

1. Packing List (must have)

What is it?

An itemized list containing product details, as well as the weight dimensions in kilograms (KG) or cubic meters (CBM).

Why do you need it?

It acts as a checklist for the exporter, customs, or other involved parties to ensure accurate packing of the shipment.

What information does it need?

A good packing list should contain the following:

• Product description

• The type of package(s), e.g. box, carton, vials, etc.;

• Quantity and weight dimensions

• Buyer and seller references

• Commercial Invoice number and/or item number

Free template:

2. Commercial Invoice (must have)

What is it?

A legal document describing the entire export transaction and the shipping terms - the prices, value of the goods, payment terms, and total invoice value.

Why do you need it?

Gives the total value of shipment, which is then used to calculate import duties and taxes.

What information does a commercial invoice need to have?

A good commercial invoice must contain the following:

• Shipping transaction (Date, invoice number, terms of sale)

• Details of goods being transported (refers to packing list)

• Harmonized System codes for those goods (aka HS Code)

• Details of exporter and the receiver

• Country of manufacturing

🚨 Important - Declared value! 🚨

What is it?

The value placed on the goods by the importers to convey the value of the shipment to freight carrier and custom control.

How is it determined?

You set the declared value at the Cost of Goods Sold (COGS) (NOT sale value/price). This is basically the price you paid to purchase the goods from the factory.

Why is it important?

Your import duties and taxes depend on it! And if anything is lost or damaged, the declared value will be used in figuring out your compensation.

Who will prepare the documents?

Your factories! They will provide both Packing List and Commercial Invoices.

So, what do you ( the importer) need to do?

You might need to help your factories gather the necessary information.

You also need to ensure there are no mistakes or missing information.

There is NO room for errors in these documents.

Customs uses these documents to classify and sort your shipment, as well as calculate duties, so any mistakes will delay your customs clearance.

3. Any other documents?

If you are shipping electronics, cosmetics, or food related products, you will need special certifications.

What are the special certifications?

Product Quality Certification, such as the CCC (China Compulsory Certification), applies to electronic goods ranging from electric tools, low-voltage appliances, wires and cables.

If you are shipping battery products or electronics, watch out for these top 3 mistakes to get your products shipped to your door safely.

FDA certification (Food and Drug Administration) is required if you’re shipping health food, supplements or formulas to certify the quality of your products.

But as a general goods buyer, you'll mainly just need the first two - packing list and commercial invoice.

So, How is import tax and duty calculated?

Formula:

The import tax and duty = total shipment value * tariff rate + import duty

How to calculate tax (aka finding tax tariff)

Each product has a tariff rate which is based on the HS code.

What is the HS code?

Harmonized Systems (HS) is an internationally recognized system of numerical codes to help with identifying the category of your goods being shipped.

HS codes help communicate what the product is, what it is made of, and from where it's coming from - so the customs authorities can quickly identify and determine tax rates.

For example:

How to find your HS code?

Let's try an example:

• Product: 100% cotton t-shirts

• Declared value: US$ 20,000

• Export Country: China

• Import Country: US

Step 1: Open the US HS code Tool to find the HS code for the cotton t-shirt

Step 2: Type your product name into the tool bar

Step 3: We search by type of material

So, Scroll down until you see “Of cotton” in the article description.

You can see that all articles of clothing made of cotton will have a heading of 6109.10

Step 4: We narrow down by usage of materials( in this case t-shirts)

We find the suffix code for t-shirts: We see that it’s 04.

So, our 100% cotton t-shirt’s HS code is 6109.10.04

Step 5: Locate the tariff rate at the heading: We see a 16.5% tariff duty rate

What happens now?

Customs sees the HS Code on your commercial invoice, and uses the product category’s tariff rate with the total shipment value on the invoice to determine your import duties.

The import duty = total shipment value * tariff rate

= US$ 20,000 * 16.5% = US$ 3,300.

Other free resource:

Find out the HS codes and the tariff rates for the following regions at their respective customs websites:

How to calculate Duty

What is customs duty?

The tax that you have to pay on the goods you bring into a country.

Do you have to pay duty on ALL goods?

Not really. There is a minimum threshold that countries set. So, if your total import value of goods is below that threshold, your goods are duty/tax-free.

Beyond the threshold, there will be duties and a sales tax, aka, GST (Goods and Service Tax) or VAT (Value-added-tax).

Here is an overview of the minimum thresholds and sales taxes across different regions.

*Different VAT rules in each EU country

** NAFTA is the North American Free Trade Agreement between US, Canada and Mexico that eliminates tariffs/duties on all imports and exports between the 3 countries.

Free resources, duty calculator:

• Duties Calculator - Australia

Importer of Record, Import Licenses, and Customs Bond.

1 .Importer of Record (IOR)

What is it?

An IOR is an owner, or buyer, or trading firm that will be in charge of all import obligations.

What does an IOR do?

They do two things:

1.They handle the documentation procedure or anything legal related to importing goods.

2.They handle all the payments of duties, tariffs and other import related costs.

Do you need an IOR?

Yes! Most countries legally require an Importer of Record (IOR) to let you import goods to the region.

What if you don’t have an importer of record in the country you sell to?

A third party, such as a trading firm can act as an IOR! The third party will arrange for a local entity to be the importer of record.

In the UK/EU, it’s different!

Business entities importing into the UK or the EU need an EORI number.

What is an EORI number?

EORI stands for Economic Operators Registration and Identification (EORI), it's an identification number that is given to let you bring goods into the UK or the EU.

Customs use the EORI to identify you across the UK/EU region. You can request an EORI number here.

2. Import License

What is an import license?

A government approved document that states that a certain entity is legally allowed to bring in certain quantities of goods into the region over a defined period of time.

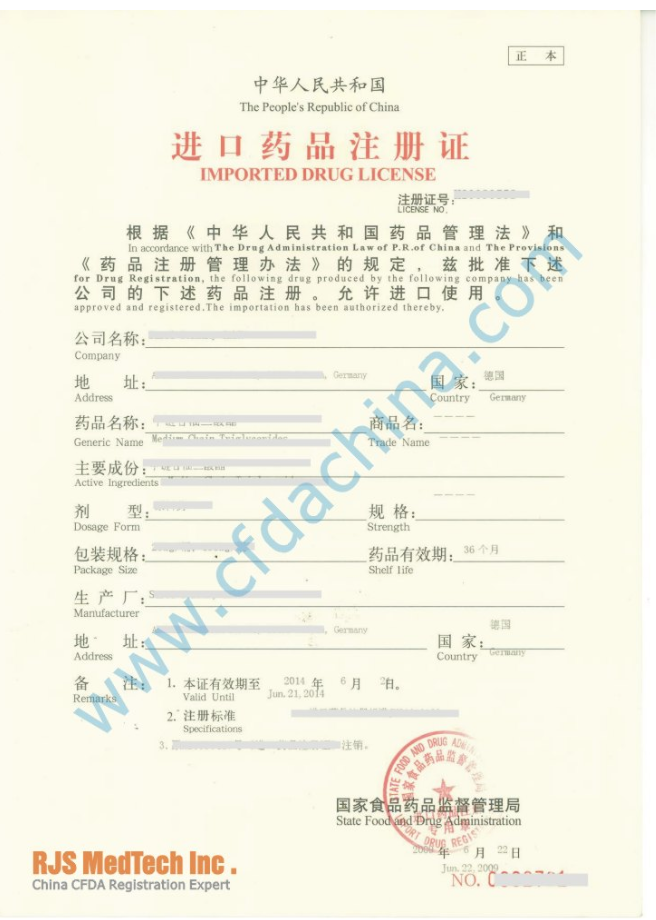

Here is what it looks like: A drug import license

Does every country need an import license?

Many countries do not require it.

Canada is an exception!

Canadian importers need to have an import license, and you can get the license by creating an account with the Import/Export Program Account. Click here to find out more.

How do you know if your goods need a license?

There are two categories of goods in imports and exports - general and restricted goods.

For restricted goods, you can refer to the following official trade organization’s links for more information.

• Restricted Goods - US (Refer to Page 106)

• Restricted Goods - Australia

• Restricted Goods - United Kingdom

• Restricted Goods - European Union

Customs Bond (Only applicable for US Market)

What is a customs bond?

A contract between the importer, customs and a third party to ensure all the duties will be paid to the customs.

Where is it required?

Only the United States requires it for importing goods into the country.

Do you really need the customs bond?

You need to get the bond if:

• the value of your imported goods is greater than $2,000 USD.

• you are importing textiles worth greater than $250.

• the products have to meet federal regulations such as firearms and food

Customs bonds can be on a per shipment basis or continuous over a period of time.

QUICK TIP: Get a continuous one to save processing times if you frequently ship to the US.

Here is a quick overview of import licenses or other specific requirements at major regions around the world.

Bookairfreight is here to help!

Click here for the documentation checklist, and templates for the packing list and commercial invoice! And while you're here, check out our comprehensive guide on how to import wigs and hair extensions from China

We guarantee:

• Instant freight quotations

• Passing customs clearance

• Painless and timely delivery of your goods.

Shoot us a quick message at booking@bookairfreight.com, or get an instant quote on our platform.

Logistics nerd and resident marketing guy of Bookairfreight. I love writing content that simplifies old-fashioned industry processes and provides solid, accurate information you can base your decisions on. Outside of logistics, I enjoy nature, hanging out with friends, electronic music and spirituality.

.png)